Markets are in a risk-off mode, with bonds, equities, and commodities (excluding gold) selling off. The dollar, typically the vehicle for safe-haven flows, is selling off too. This makes sense, as the uncertainty stems from Trump’s tariffs and the potential consequences of a trade war. Since the dollar isn't eligible to absorb safe-haven flows, the euro and the Swiss franc did the job.

The yen didn’t do much probably cause there was no one else to buy as net positioning already reached record longs

The trade war has abated temporarily to only the US and China but that did nothing to convince traders and investors to move money back to equities and risk and assets. Currencies like the NOK,AUD,NZD and the Rand all took a hit. Implied vol is still elevated across all major currencies

Politically speaking, i do not think China and Trump can come to agreement economically, i think contrary. The nature of the decisions and reasons for them do not matter to us as much as their effects on asset prices. The dollar is down specifically due to uncertainty on trade. If tariffs are scaled back substantially in some way we could see the dollar regain strength and become tradable owing that tentative characteristic to price action

looking at Short term interest rate (STIRS), probability for rate cuts have been scaled back by interest rate traders

It's about 80% certainty of a no-change decision in the next FOMC meeting

The window for these variables to convince dollar traders on how high the price can go is closing The rate of core CPIYOY is finally breaking to the downside

Plus forecasts for growth aren’t exactly as high as they used to be. The recline in rate cut expectations is as a result of the possibility of tariffs bringing back inflationary forces members of the feds worked so hard to deal with it. An upside on the dollar would be justified if we do see inflation as a problem again albeit unlikely. Both macro and fundamentals are bearish the dollar

Question is how low can it go

The story in the UK is quite different from the US. TE forecasts for growth have risen from 0.3% to 0.6% and the next interest rate reduction won't come till may. UK core inflation is still at a range

All indicators point to the pound retracing it's decline from early April

Core CPI surprising to the downside or Trump trying to make a deal with the UK and using tariffs as leverage could put a dent on our long pound thesis. The euro is overpriced and i think this is obvious cause i saw a trader talking about shorting EURGBP. Would have worked well just that the euro leg is supported by risk off sentiment that still seems to exist in markets. Australian dollar and new Zealand Zealand are currencies suffering from the risk off sentiment. The former has the potential of climbing higher as rates have only be lowered once by the RBA (Reserve bank of Australia) putting Australia at the back of the line in the race of rate cuts. This isn't exactly a bullish catalyst just an indication that there is a window for one (a bullish catalyst) to push the australian dollar price up substantially. Positioning is very negative

A rebound in iron ore or halt in decline would favour the AUD long idea

Just as a rebound in crude will favour the Norwegian krone

In South Africa tariffs have brought down the price which erased the room we had to sell due to lower rates. Interest rates are still elevated relatively and has much room to go lower

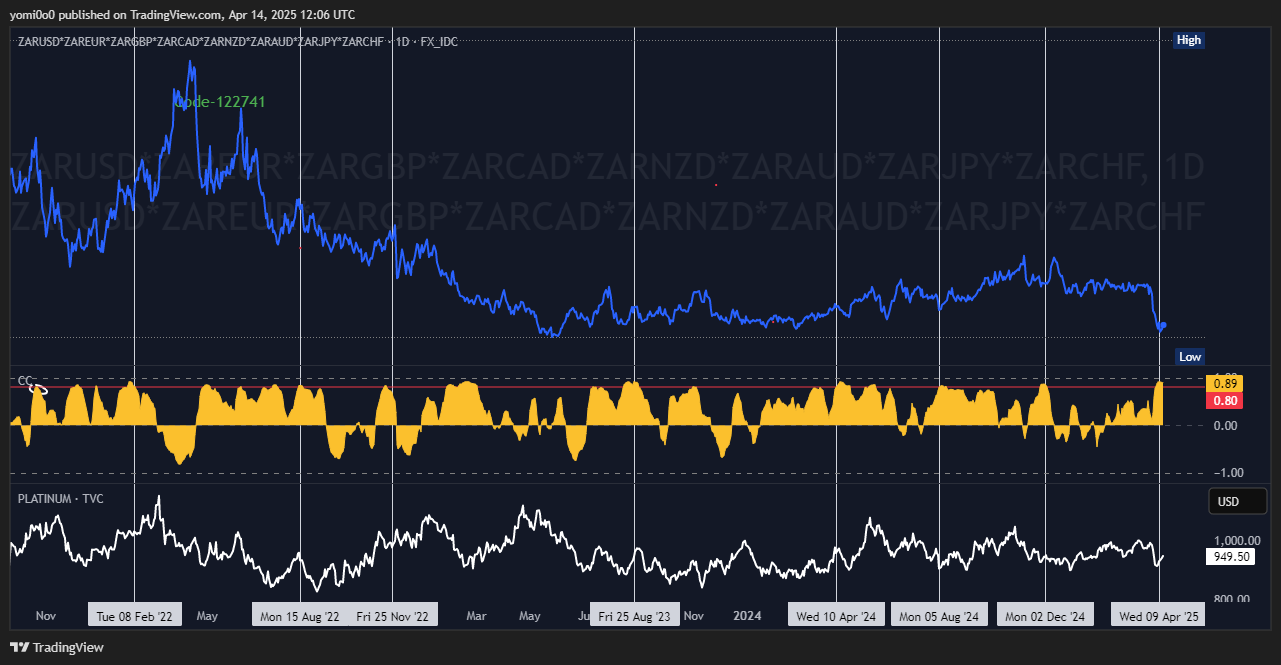

platinum responsible for a significant part of the rand price action due to it's weight in foreign trade is retracing some of it's albeit still in the lower part of it's range.

correlation between the rand and platinum is currently 0.89

Anytime correlation was that high (above 0.8) either the metal or the currency had to give

The likely cause: the catalyst that drove both assets in the same direction had to reverse, returning the price driver to basic fundamentals.

The inflation print on Wednesday, April 23, could resume the bearish trend if CPI surprises lower than expected.

A move higher until the inflation date is probable, as long as risk-off events are not in play.

Tactical play

Long ZARJPY

Long GBPJPY